LC forecasts double-digit growth in optical product revenue over the next five years

- News

- 2022-04-29

- Views:

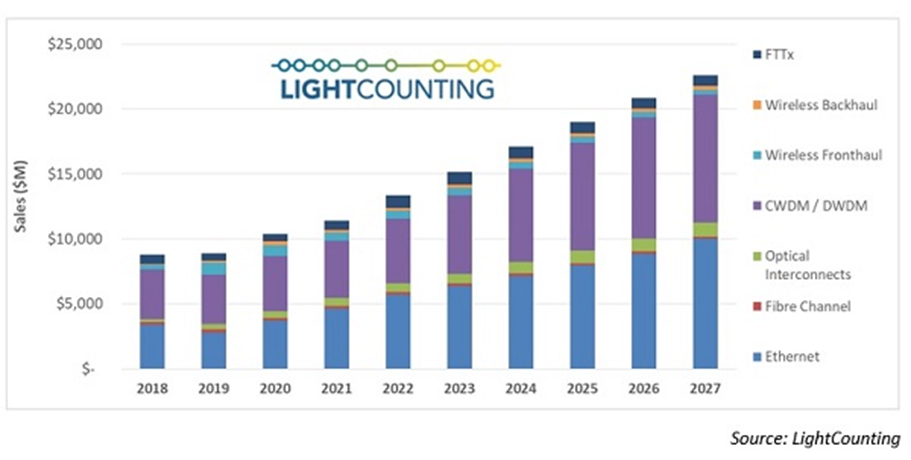

(Summary description)Recently, Light Counting (LC) released its latest optical device forecast for the next five years. LC believes that after 9% and 17% growth in 2021 and 2020, the global transceiver market revenue will continue to grow strongly (17%) in 2022. Demand for optical products is strong across all segments, and continued bottlenecks in the global supply chain may have created some additional demand (over-ordering) and of course moderated price declines leading to higher-than-expected sales growth in 2021 and the increase of forecast for 2022-2027, which is as shown in the chart below.

LC forecasts double-digit growth in optical product revenue over the next five years

(Summary description)Recently, Light Counting (LC) released its latest optical device forecast for the next five years. LC believes that after 9% and 17% growth in 2021 and 2020, the global transceiver market revenue will continue to grow strongly (17%) in 2022. Demand for optical products is strong across all segments, and continued bottlenecks in the global supply chain may have created some additional demand (over-ordering) and of course moderated price declines leading to higher-than-expected sales growth in 2021 and the increase of forecast for 2022-2027, which is as shown in the chart below.

- Categories:News

- Author:

- Origin:Information Stone Optical Communication Network

- Time of issue:2022-04-29 16:45

- Views:0

Recently, Light Counting (LC) released its latest optical device forecast for the next five years. LC believes that after 9% and 17% growth in 2021 and 2020, the global transceiver market revenue will continue to grow strongly (17%) in 2022. Demand for optical products is strong across all segments, and continued bottlenecks in the global supply chain may have created some additional demand (over-ordering) and of course moderated price declines leading to higher-than-expected sales growth in 2021 and the increase of forecast for 2022-2027, which is as shown in the chart below.

According to the latest forecast, the CAGR (compound annual growth rate) for 2022-2027 is 12% which is not too much different from the CAGR announced in October 2021 which is 13%. Strong sales of DWDM and Ethernet optics account for most of the growth in 2021, and these segments are expected to continue to lead growth in 2022-2027.

Sales of optical interconnect (mainly active optical cables) will also grow at a double-digit (10%) CAGR over the next five years. The wireless fronthaul segment was a weak area, with falling prices coupled with cyclical declines in unit shipments resulting in negative sales growth.

Scan the QR code to read on your phone

The 2021 revenue ranking of China's local electronic components distributors is released!

Recently, ASPENCORE and ESM China jointly released the 2021 "Revenue Ranking of Local Electronic Components Distributors in China". The list shares the current situation and development of China's distribution industry based on observations and interviews with local distribution companies in China. The respondents of the report are all electronic component distributors that have established corporate headquarters in China, and their revenue in 2021 has exceeded one billion RMB, and the distribution business has accounted for more than 60% of the revenue. For the first time, the report combines both directional invitation and questionnaire survey. All ranking data are derived from voluntary disclosure of companies or financial reports of listed companies.

LC forecasts double-digit growth in optical product revenue over the next five years

Recently, Light Counting (LC) released its latest optical device forecast for the next five years. LC believes that after 9% and 17% growth in 2021 and 2020, the global transceiver market revenue will continue to grow strongly (17%) in 2022. Demand for optical products is strong across all segments, and continued bottlenecks in the global supply chain may have created some additional demand (over-ordering) and of course moderated price declines leading to higher-than-expected sales growth in 2021 and the increase of forecast for 2022-2027, which is as shown in the chart below.